Presumably, most people across the globe know their home equity. Many of them, however, got lost on this line. As a homeowner, you must fully understand how home equity works. This is especially true if you want to refinance your mortgage or take out a loan against your home. This is a simplified guide that will help you calculate home equity seamlessly, covering everything you should know about home equity, home equity loans, and everything you should know down the road.

What is home equity?

Simply put, the value of a homeowner’s equity in their home is called home equity. In other words, it is the current market value of the property ( minus any liens attached to the property). Therefore, the equity amount of a home (or its value) fluctuates over time as more mortgage payments and market forces affect the present value of the property.

How does equity work in the home?

When purchasing part or all of a home with a mortgage, the lender retains a lien on the property until the loan is repaid. The portion of the present value of the property that the owner owns at any time is called the home equity.

The down payment you make when you initially buy a property is how you build your home equity. Then, when the contracted amount of your mortgage payment is allocated to reduce the remaining principal of the loan you still owe, you’ll get greater equity through your mortgage payment. An appreciation in property value may also benefit you as it increases the value of your assets.

On the other hand, what is a home equity loan?

What exactly is a home equity loan and how does it work?

A home equity loan is a debt consolidation loan that uses your property as collateral. Home equity loans and home equity lines of credit (HELOC) are two types of home equity loans.

However, a home equity loan is similar to a personal loan in that you receive a one-time payment from the lender and repay the loan in monthly installments. On the other hand, a HELOC works like a credit card in that it allows you to borrow money as needed. The lottery period for HELOCs is usually 10 years. During this period, you can use the funds in your line of credit, and you will only pay interest.

Both options require you to have a specific amount of home equity, which is a percentage of the property you own. Lenders typically require you to own 15% to 20% equity in the home.

Divide your current mortgage balance by the market value of your home to determine how much equity you have. For example, if your current balance is $100,000 and the market value of your home is $400,000, you own 25% of the property.

If you can afford to repay the amount, a home equity loan can be a great option. Lenders may foreclose on your home if you are unable to repay the loan. This can damage your credit, making it difficult to qualify for future loans.

Basic Uses of Home Equity Loans

According to Bankrate, the most common reasons for homeowners to borrow from their equity are debt consolidation and home improvement. Borrowers may use home equity for a variety of reasons, including education expenses, vacations, or other large purchases.

Borrowers can deduct interest paid on HELOC and home equity loans if they use the funds under the Tax Cuts and Jobs Act of 2017 to purchase, develop, or improve a home that is used as collateral for the loan.

However, the interest rate on a home equity loan depends on the lender and the home equity product you choose. For example, in 2020, home equity loan rates range from 5.1% to 5.89%, while HELOC rates range from 4.52% to 6.2%.

On the other hand, one downside is that home equity loans and lines of credit have the same closing fees and fees as traditional mortgages. Closing costs vary but can run into hundreds of dollars depending on the value of the property.

How to Apply for a Home Equity Loan

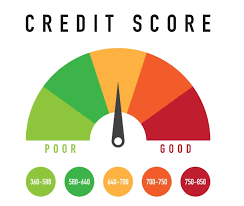

Start by verifying your credit score, determining the equity amount of your property, and checking your finances before applying for a home equity loan.

Next, check out home equity loan rates, minimum requirements, and fees from various lenders to see if you can afford a loan. When you use it, also double-check that the lender offers the home equity product you need; some only offer home equity loans or HELOCs, not both.

Personal information such as your name, date of birth, and Social Security number will be requested when applying. You must also provide evidence such as tax records, pay stubs, and confirmation of home insurance.

How much equity does your home have?

The difference between your property’s current market value and the total loan against it (most notably your primary mortgage) is your home equity value.

The amount of credit you can get with a home equity loan depends on how much equity you have. Let’s say your home is worth $250,000 and your mortgage balance is $150,000. If you deduct the rest of the mortgage from the home value, you’ll have $100,000 in home equity.

Image Credit: BetterMoneyHabits (How to Calculate Home Equity)

Subtract the amount you owe on all loans secured by the home from the home’s appraised value to determine how much equity you have in the home.

How Much Home Equity Loan You Can Get and How to Calculate

Only a few lenders allow you to borrow the full amount of your home equity. Depending on your lender, credit, and income, you can usually borrow 80% to 90% of your available assets. So, in the above scenario, if you have $100,000 in home equity, you might receive a Home Equity Line of Credit (HELOC) of $80,000 to $90,000. Race, national origin, and other non-financial factors should never be considered when assessing how much home equity you can borrow.

This is a second example that considers more variables. Let’s say you’ve paid for your property for five years and have a 30-year mortgage. Also, based on a recent appraisal or appraisal, your home has a market value of $250,000. Let’s say you still owe $200,000 on your original $195,000 loan. Remember that nearly all early mortgage payments go toward paying interest.

In other words, if the property has no other debt, your home equity is $55,000. This equals the current market value of $250,000 minus the debt of $195,000. You can also calculate your home equity percentage by dividing your equity by the market value. In this case, the home equity ratio is 22% ($55,000 divided by $250,000 = .22).

Say you have a $40,000 home equity loan in addition to your mortgage. The property’s total debt is not $195,000, but $235,000. Your overall equity falls to $15,000, bringing your home equity percentage down to 6%.

transaction cost

Since real estate is one of the most illiquid assets, taking a loan on home equity often comes at a cost. If you end up selling the home, the total closing fee in the US is usually between 2% and 5%. Many of these fees are usually paid by the buyer, but be aware that they can be used as a reason to negotiate a lower sales price.

If you take out a home equity loan, you will almost certainly have to pay a loan origination fee. Second mortgages and home equity lines of credit (HELOCs) typically have higher interest rates than initial mortgages. After accounting for these transaction fees, you can use less home equity than you theoretically have.

loan-to-value ratio

The loan-to-value ratio is another way to communicate home equity (LTV ratio). This figure is calculated by dividing the remaining loan balance by the current market value. In the second case above, your LTV is 78%. (Yes, it’s the opposite of your 22% home equity percentage.) When you add a $94 home equity loan, it rises to 40,000%.

Lenders don’t like high LTVs because they indicate that you may have used too much leverage and may not be able to service your debt. They may tighten lending conditions in times of economic turmoil. A perfect scenario emerged during the economic crisis of 2020. Banks have increased their credit scores from 600 to 700, especially the Home Equity Line of Credit (HELOC). The amount they are willing to lend and the percentage of home equity they are willing to offer has also decreased.

Also, when the market value of a home fluctuates, both LTV and home equity fluctuate. During the 2007-2008 subprime mortgage crisis, millions of dollars in apparent home equity were wiped. Prices don’t always go up. The long-term impact of the 2020 crisis on home equity is unclear. Global house prices are expected to rise through 2021 due to stay-at-home policies and individuals seeking larger housing to accommodate their work, education, and personal lives.

Additionally, the company’s expanded work-from-home policies, which may go beyond COVID, have drawn many families from cities to the suburbs.

How does the loan-to-value ratio affect your loan?

The loan-to-value ratio is a common metric used by lenders to make lending and financial decisions (LTV). When you first apply for a mortgage, this calculation compares the loan amount you seek to the value of the home. If you have a mortgage, your LTV ratio is calculated using your loan balance. If your LTV ratio is high, you may be forced to pay private mortgage insurance (PMI), or you may be able to refinance.

Divide your existing loan balance (found on your monthly statement or online account) by your home’s appraised value to get your LTV ratio. To convert this number to a percentage, multiply it by 100.

Image Credit: BetterMoneyHabits (How to Calculate Home Equity)

Equity and Private Mortgage Insurance

If you paid private mortgage insurance (PMI) on your first mortgage, keep track of your loan-to-value ratio. The Homeowner Protection Act forces lenders to automatically remove PMI when a home has an LTV ratio of 78% or less (provided certain requirements are met). Your loan will usually be canceled when your total loan amount reaches 78% of the home’s initial appraised value. If your LTV ratio falls below 80% early due to additional payments you made, you have the right to ask your lender to delete your PMI.

Get a Home Equity Line of Credit (HELOC)

Another key statistic if you’re considering a home equity loan or line of credit is your combined loan-to-value ratio (CLTV). The value of your home compared to the total loan secured against it; including the loan or line of credit, you are looking for.

Trisha has a $140,000 loan outstanding and wants to apply for a $75,000 home equity line of credit. If she is admitted, she will calculate her CLTV ratio as follows:

Calculate the loan-to-value ratio using the combined loan-to-value ratio;

Source: BetterMoneyHabits (How to Calculate Home Equity)

To qualify for a home equity line of credit, most lenders require a CLTV ratio of less than 85% (although the percentage may be lower or vary by lender), so Trisha is likely eligible.

However, it’s important to remember that the value of your home can change over time. If the value drops, you may not be eligible for a home equity loan or line of credit. To make matters worse, you could end up paying more than your home is worth.

How can you increase your home equity?

If the value of your property declines over time, your assets may also decline. After you can calculate the variables, you can rebuild or increase your home equity (if it stays the same) by paying down the loan principal and lowering the loan-to-value ratio. However, this happens automatically if your payments are amortized (i.e. based on a plan that allows you to repay the loan in full at the end of the loan term).

So, if you want to lower your LTV ratio faster, consider making more monthly mortgage payments than you need. This can help reduce your loan balance. (Make sure your loan doesn’t have any prepayment penalties.)

Also, preserve the value of your home by keeping it clean and well-maintained. You can also increase the value of your home through remodeling. However, you should consult an appraiser or real estate advisor before investing in any renovations that you expect will increase the value of your home. Remember that no matter what you do, financial conditions can affect the value of your home. If home prices rise, your LTV ratio will fall, your home equity will rise, and falling home prices will offset the value of any upgrades you make.

What is the importance of home equity and knowing how to calculate it?

Increasing your home equity is critical for several reasons. First, it helps your net worth because, unlike almost all other assets you buy with a loan, your home can continue to appreciate after you pay it off. You can also use your assets to support living expenses such as home improvements, a down payment on a second property or school – we’ll get to that later. In the end, the more equity you build in your home, the more profit you can make when you sell your home. However, equity takes time to grow, so it should be part of a long-term financial strategy, not a quick cash plan.

On the other hand, none of this is possible without a solid understanding of how to calculate your home equity, LTV, etc.

What are my options for accessing my home equity?

Now that you know how to calculate your home equity, you also need to know how to access it. There are multiple ways to access your home equity, each with its advantages and disadvantages. Here are some of the most popular:

Home Equity Loans: Loans with fixed interest rates and one-time payments with predictable monthly payments.

Home Equity Line of Credit (HELOC): A revolving line of credit that allows you to borrow money using some of the equity in your home.

Cash-in Refinance: Replaces your current mortgage but is larger than your total loan amount, allowing you to pay the difference.

Reverse Mortgage: A loan for homeowners 62 and older where the lender repays your equity.

Home Equity Investments: These loans provide you with near-instant funding in exchange for a percentage of your home’s future value without requiring you to sell or take on more debt. No need to worry about monthly payments or interest.

What can I do with my equity?

While there are many ways to use your home equity, using it carefully and strategically in how you use the money you earn will pay off in the long run. For example, it’s a better decision to spend money on home upgrades that might increase your home’s value, rather than going on a luxury vacation or shopping spree. Here are other options to keep in mind:

#1. get out of debt

One of the most common reasons homeowners use their assets is to pay down debt, such as credit cards and student loans. This can be made easier with a home equity loan as there is no need to worry about monthly payments.

#2. Renovate your home

Home improvement and renovation projects are other typical uses of equity. There are too many advantages. First, you’ll enjoy the luxury and fun of having an ideal kitchen or lovely patio. As mentioned earlier, remodeling may also make you more money for your home if you decide to sell in the future.

#3. buy a second home

Have you ever thought about owning a vacation home? What about rental properties that can generate additional income? You can use your assets to help make a down payment on a new home. You will diversify your portfolio with real estate in addition to having a destination to go on vacation.

#4. your company’s funds

Plenty of homeowners uses their home equity to build or expand their small businesses without having to apply for a loan (and the hurdles that come with getting loan approval).

#5. happy retirement

If you need money for current or future expenses that your retirement savings can’t cover, such as health care, your home equity can help you with peace of mind and some extra cash. This is especially attractive if you plan to sell your house within the next ten years. While not required, it may be advantageous to use the funds from the sale of the home to pay for a retirement plan.

#6. investment education

With college tuition rising every year, using your equity to help pay for your child’s education or start paying off student loan debt may be a smart decision.

#7. Diversify your portfolio

Home equity investing is a popular way for homeowners to diversify their portfolios. A well-rounded portfolio includes stocks, bonds, mutual funds, and real estate, as well as other investments that span at least a few different industries. You can reduce the risk of major losses in one place by diversifying your assets.

#8. Invest in your growing family

It’s no secret that the cost of raising a family, whether it’s a first or fourth child, can add up quickly. Childbirth, IVF, adoption, surrogacy, and child-rearing can all be paid for with equity in your home.

#9. get emergency funding

Unexpected events abound in life. Whether you need cash for quick medical bills or other unexpected expenses, your home equity can help.

These are just a few examples of a life where you can use your assets to reduce stress—and home equity investing can help you do it without taking on debt, worrying about monthly payments or interest, or selling your property. Now you can decide how to use your home equity because you know how to calculate it, what it is and why it matters!

Disclaimer!

Every effort has been made to ensure that the information in this article is as accurate as possible as of the date of writing, but circumstances may change rapidly. BusinessYield Consult does not endorse or monitor any linked websites. Individual circumstances vary, so consult a financial, tax, or legal professional to find out what works best for you.

How to Calculate Home Equity FAQs

How do I calculate 20% equity in my home?

To calculate the 20% equity in your home, you need to follow these steps;

- Determine the fair market value of your home. To appraise your home, please contact a professional appraiser.

- Calculate the amount you owe on your mortgage.

- To figure out how much equity you have, subtract your loan balance from the fair market value of your home.

How to calculate equity percentage?

To calculate your home equity percentage, divide your equity by the market value of your home. (45,000 divided by 200,000 is 22.5) In this case, your home equity percentage is 22.5%.

What are the payments on a 50,000 home equity loan?

An example of a loan payment would be $501.49 per month for a loan of $50,000 with a 3.80-month interest rate of 120%.